You're here:

Collect Customer Location Evidence

2015 VAT rules might be a nightmare, especially if you run an online business. But Quaderno wants to make your accounting easier, so you can focus on your product or service.

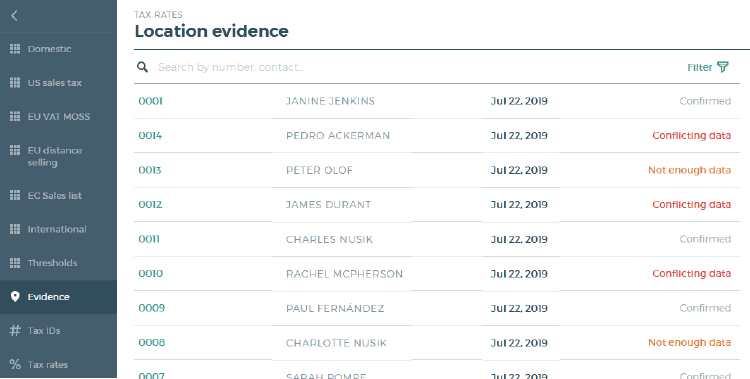

As we said in our previous post, from now on it is mandatory to keep (during 10 years) at least two non-contradictory evidence that can proof the location of your customers for EU VAT OSS. That’s why we are introducing the Customer Location Evidence feature.With Quaderno, you can collect automatically 3 evidence for each payment: the billing address, the IP address, and the location of the customer’s card.

Every day, we’ll run a check on all the payments you have received, and we’ll send you a notification in the case some of the evidence are returning a wrong validation. If we came across a wrong validation of one of the evidence, you will have to ask your customer for an additional evidence.

You don’t need to take any extra step to make available this feature within your account. You will find it within your account > Taxes > Evidence.

More than happy to get your feedback on this!

Note: At Quaderno we love providing helpful information and best practices about taxes, but we are not certified tax advisors. For further help, or if you are ever in doubt, please consult a professional tax advisor or the tax authorities.