Tax automation for platforms & marketplaces

Give your users automatic tax compliance for all worldwide sales through Quaderno’s flexible API tools.

Give your users automatic tax compliance for all worldwide sales through Quaderno’s flexible API tools.

Offer automatic tax compliance to your customers, so they can grow confidently and focus on the work they love.

Quaderno monitors US economic nexus, VAT & GST thresholds in real time, based on your sales data. New registrations are taken care of automatically.

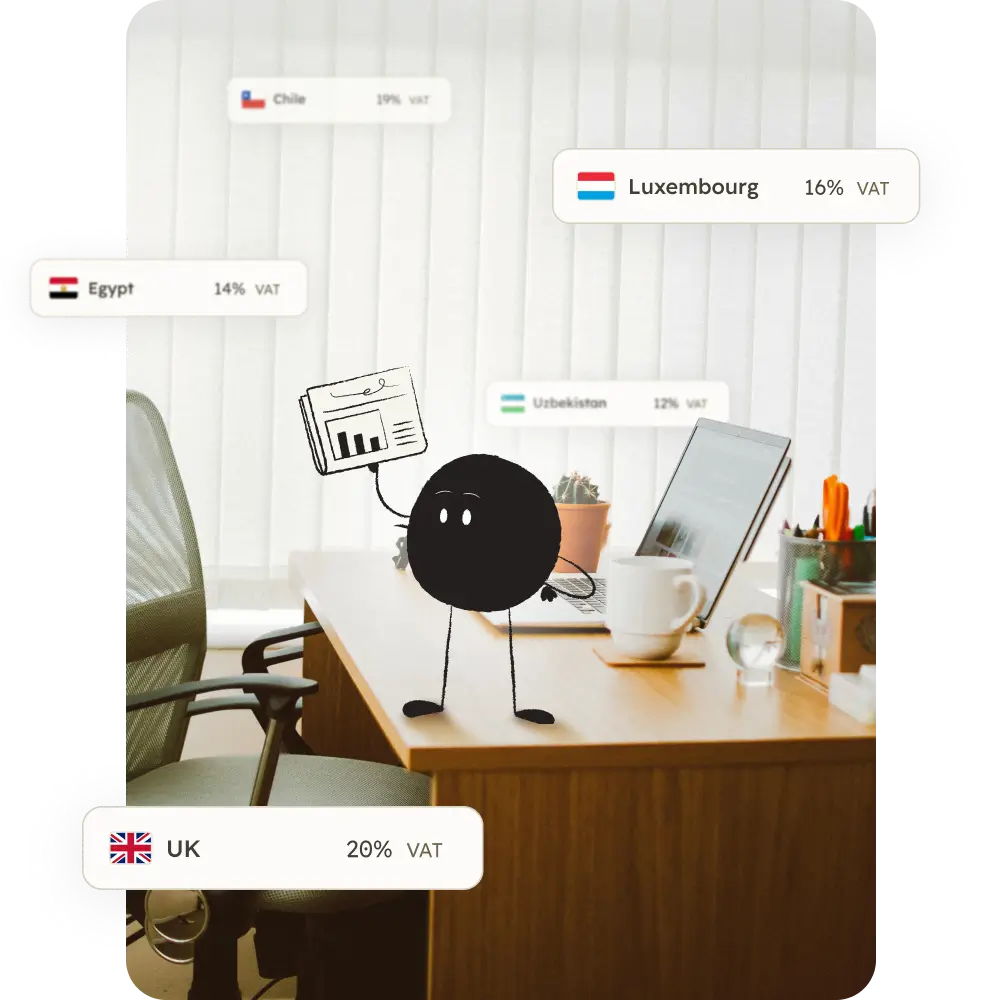

Quaderno supports over 12,000 tax jurisdictions worldwide. Every sale automatically has the correct local tax rate, based on your customer's location and the product category.

Merchants can provide documentation for every sale – customized to their brand and tailored to their customer’s language and currency worldwide.

Quaderno Reports provide the transaction data you need to file VAT, GST, and sales tax returns seamlessly on your own. Or our filing service can do it for you automatically!

The best thing about Quaderno is that it gets our data straight from the payment platforms. Hence, we have 90% of the work already done.

Quaderno Connect’s API is as simple or complex as necessary, and it easily scales with your business. You make the API calls, we handle the tedious tax details on our end.

Check out our resource library for more information on your business tax obligations.

Following the rise of tax laws for e-commerce platforms, we’ve created a comprehensive list of every country and jurisdiction in the world with marketplace tax laws.

Learn how marketplace facilitator laws affect online sellers that use platforms like Amazon, eBay & Etsy.

Selling courses online? Learn global tax rules for digital products, including VAT, GST, & sales tax, and how to stay compliant with ease.

Explore our Developers Hub to learn more. Or contact us to discuss the right solution to meet your needs.