If you’re selling digital services and products to customers in Georgia, then you might be liable for Georgia’s sales tax. This guide helps you with:

- The 7-step process of how to register for Georgia sales tax online, and

- How to file sales tax returns in Georgia on time

We’ve scoured the Department of Revenue website to provide you with all the necessary information about Georgia sales tax for out-of-state businesses in one place.

How do I register for sales tax in Georgia?

Remote sellers can register online for sales tax in Georgia through Georgia Tax Center, an online portal that provides various tax services. This portal is also where you’ll file and pay your tax returns. More on that later!

The first step is to register for a sales tax license and receive a tax number. This is a simple process! But before you begin, have this information handy:

- Your Social Security number (if registering as a sole proprietor with no employees)

- Your Employer Identification Number (EIN)

- North American Industry Classification System number. Each number is a 2-6 digit code. Find yours in the NAICS directory.

- The date of your first sale in Georgia

Apply for a sales tax license in Georgia

- Go to the Georgia Tax Center registration page. Click ‘Continue’ and head to the first page of the application.

-

On the next page, enter your business’ physical address. At the bottom of the page, you’ll need to verify the address with the system's registry.

-

Select which taxes you’re registering for. For most remote sellers, this will only be the Sales & Use Tax category.

- Next you’ll answer specific questions about your sales in Georgia and your accounting method. Your options are either cash basis or accrual accounting.

- On the following page, you’ll enter more business information and your NAICS code. If needed, you can search for your NAICS code directly on the page! A box will appear, where you can search by keyword. Then select the code most relevant to your business. Here’s an example with the keyword “software.”

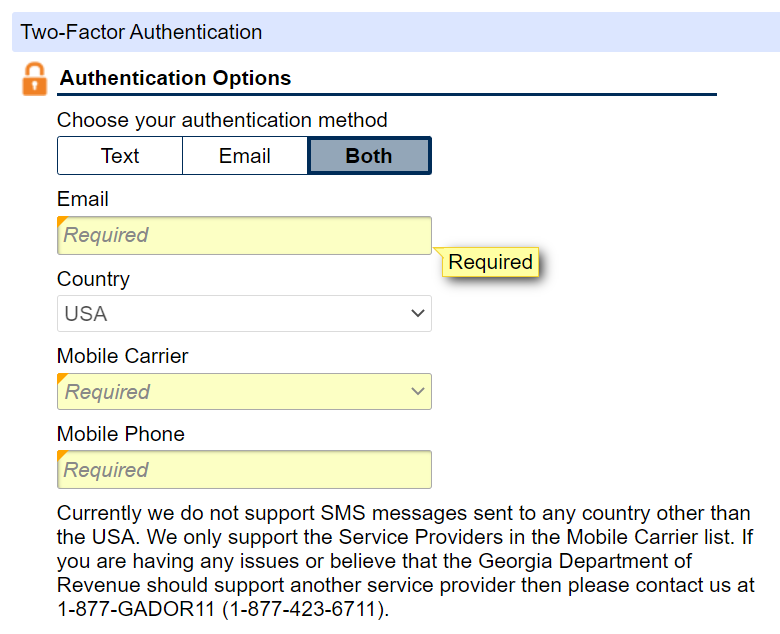

- Next you’ll create Login Information for your new Georgia Tax Center account. On the very next page, you’re asked to set up Two Factor Authentication for your own security.

Important: Businesses with international phone numbers cannot choose the Text option! You must choose email. See the disclaimer in the screenshot below.

- Finally, review some basic details of your account. If everything is correct, click “Submit” and you’re done! You should receive a confirmation right there on the screen and via email.

The website doesn’t state how long you should expect to wait, but if you have any questions, simply log in and contact customer support.

Once your application is reviewed and approved, you should receive a seller’s permit and a Georgia business tax ID.

You’ll also be assigned a monthly tax filing frequency, as a newly registered business. More on that below!

How do I file sales tax returns in Georgia?

Sales and taxes should be reported and filed using US dollars. If you’ve made any transactions in Georgia in a different currency, be sure to convert those to USD using official currency exchange rates.

When to file and pay sales tax in Georgia

For the first 6 months, you must file Georgia sales tax returns monthly. After that, if your tax liability is low enough, you can request a lower filing frequency such as quarterly or annually.

The deadlines are as follows:

Monthly

For monthly filers, reports are due on the 20th day of the month following the reporting month. For example, the July sales tax report is due August 20.

Quarterly

For quarterly filers, reports are due on the 20th day of the month following the reporting period.

- April 20, for first quarter ending March 31

- July 20, for second quarter ending June 30

- October 20, for third quarter ending September 30

- January 20, for fourth quarter ending December 31

Annually

For annual filers, reports are due on January 20 following the reporting year.

Note: You must still file every quarter even if you made no sales in Georgia! This is typically called a “zero return” and it follows the exact same process as a normal return. (Just a little less data entry 😉)

How to file tax returns in Georgia

Before you get started, you should collect all the information about your taxable sales in Georgia during the previous quarter. The tax website suggests having these pieces ready:

- total sales and income

- total purchases and expenses

You can file online in the Georgia Tax Center. You can log in here.

Once submitted, you should receive confirmation there on the screen and via email.

How to pay sales tax in Georgia

Tax payments must be made electronically and in US dollars. You can pay directly at the time of filing through your Georgia Tax Center account.

Payments must be made through electronic funds transfer (EFT) or ACH Debit.

What to do in between registering and filing?

So, you’ve learned how to register & file taxes online in Georgia. Now you must comply with all the rules for Georgia sales tax! That means charging 4% sales tax and watching out for local level taxes, among other things.

For further reading that will help you stay compliant and successful as a remote seller, check out our Guide to Sales Tax in Georgia.

Note: At Quaderno we love providing helpful information and best practices about taxes, but we are not certified tax advisors. For further help, or if you are ever in doubt, please consult a professional tax advisor or the tax authorities.