Hey, you! Are you charging your EU customers VAT? What about that sale yesterday was EU digital tax added? Was it at the right rate? Was the buyer a business or an end-consumer? How are you storing your invoices?

If you don’t know how to answer these questions, this guide is for you.

Every company selling digital goods to a customer in the EU needs to be on their game when it comes to VAT rules. It doesn’t matter if your business is actually in the EU or not.

That’s because if your customer lives in one of the 28 member states of the European Union, you’re on the hook for Value-Added Tax. You must charge tax during the sale, collect it from the customer, and then later file and pay it to the government. Forget to charge your customer? Really sorry, but then you’ll have to pay the tax from your own pocket.

Let’s make sure you avoid that unpleasant surprise and any other confusion in the EU tax process. How to comply with EU VAT can actually be quite simple, as long as you have the right information.

What is EU VAT?

It's Value-Added Tax, a general consumption tax on a good or service. It is applied to every sale made in the EU. “Consumption tax” means that the tax is paid by the consumer, not by the business who makes the sale. That’s why you, as a business owner, need to know when to charge your customers this tax!

As for how much to charge, this depends. There is no universal rate for digital goods. Instead, the rates vary from 17-27% across all the countries. If you’re curious about specific national rates, all of those are listed later on in this guide.

What are the VAT rates in Europe?

Check out the table below to see the current EU VAT rate in each country:

| Code | Name | Rate |

|---|---|---|

| AT | Austria | 20% |

| BE | Belgium | 21% |

| BG | Bulgaria | 20% |

| CY | Cyprus | 19% |

| CZ | Czech Republic | 21% |

| DE | Germany | 19% |

| DK | Denmark | 25% |

| EE | Estonia | 20% |

| ES | Spain – Península y Baleares | 21% |

| FI | Finland | 24% |

| FR | France | 20% |

| GR | Greece | 24% |

| HR | Croatia | 25% |

| HU | Hungary | 27% |

| IE | Ireland | 23% |

| IT | Italy | 22% |

| LT | Lithuania | 21% |

| LU | Luxembourg | 17% |

| LV | Latvia | 21% |

| MT | Malta | 18% |

| NL | Netherlands | 21% |

| PL | Poland | 23% |

| PT | Portugal | 23% |

| RO | Romania | 19% |

| SE | Sweden | 25% |

| SI | Slovenia | 22% |

| SK | Slovakia | 20% |

Additionally, we often have users at Quaderno inquire about the VAT rates in Norway (25%), the UK (20%), and Switzerland (7.7%).

Be sure to check out our up-to-date tax guides to confirm the different VAT rates in all of the European countries.

What is a digital good?

Can your product be picked up, carried, and put in a box to ship somewhere? If yes, then you should actually be reading this article on distance selling in the EU. If no, keep reading!

The EU VAT rules we’re about to explain only apply to digital goods and services. They do not apply to physical products, which have their own separate rules involving cross-border customs and taxes.

So the first question to answer is: what’s considered a digital good, anyway?

A digital good is any product that’s stored, delivered, and used in an electronic format. These are products that the customer receives via email, by downloading them from the Internet, or through logging into a website.

That definition is pretty broad, but it’s supposed to be. At the rate that technology develops these days, there’s no point in using more specific or precise language, because a new, totally unforeseen product could be on the market in a matter of weeks. If it fell outside of a limited definition of “digital good,” then figuring out how to regulate and tax it would be another nightmare. So, we stick with the broad definition.

That said, the European Commission does have four criteria that will certify whether something is a digital good. Drumroll, please:

- It is not a physical, tangible good.

- It’s essentially based on IT. The offering could not exist without technology.

- It’s provided via the Internet or an electronic network.

- It’s fully automated or involves minimal human intervention.

Those four criteria are specific enough to ensure only digital products are included, but loose enough to allow for plenty of innovation.

Some common digital goods on the market today include:

- Downloadable and online games.

- E-books, images, movies, and videos, whether buying a copy off Amazon or using a service like Netflix.

- Downloadable and streaming music, whether buying an MP3 or using a service like SoundCloud or Spotify.

- Cloud-computing software and Software-as-a-Service (SaaS), such as Quaderno ;)

- Websites, site hosting services, and internet service providers.

Heads up: you might also hear digital goods referred to as “digital services,” “e-goods,” or “e-services.” All of these terms refer to the same thing.

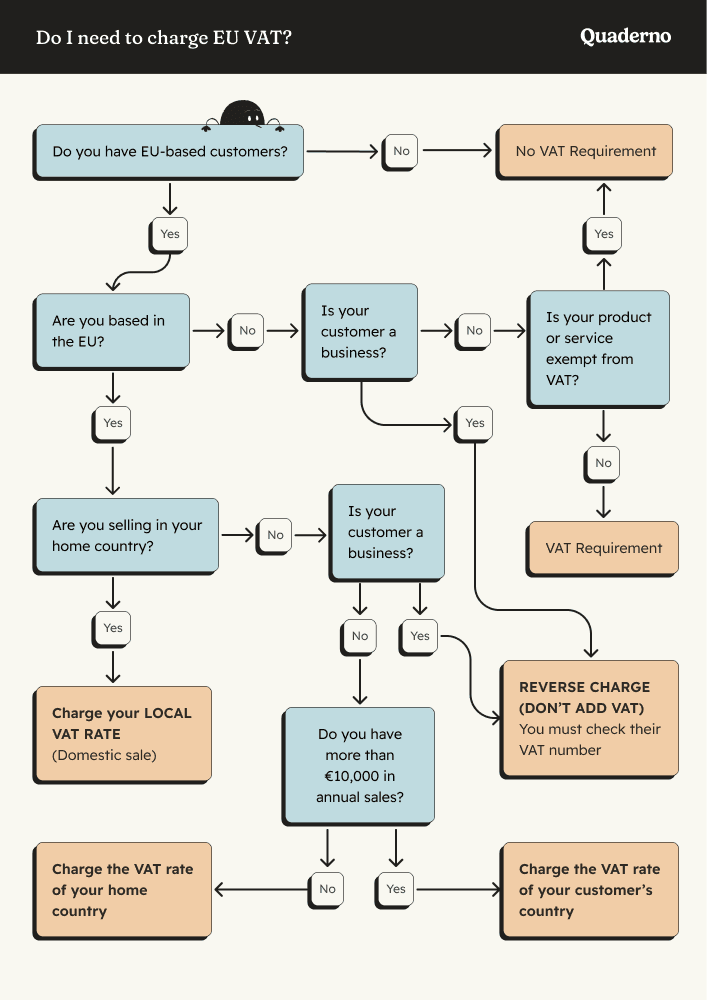

When should I charge EU VAT?

It’s important to know when to charge VAT because… you don’t always have to charge VAT. You need to consider it with every sale, for sure, but you don’t need to collect it from the customer every time.

The question of charging and collecting EU VAT comes down to two factors:

- Where your customer is located

- Whether the transaction is B2B or B2C

If you’re a European business, you always charge VAT in your home country. Nothing else matters. You charge VAT on every sale of digital goods.

But when selling elsewhere in the EU, there are differences in B2B and B2C.

In B2B you don’t need to charge VAT; there is a reverse-charge method wherein the buyer pays VAT to their own government. This saves you trouble, as you don’t have to file a separate tax return in each country where you make a sale. You just need to receive a valid VAT number from the buyer, which you can validate with the VIES service from the European Commission. In case you require further explanation about this VAT number lookup service, we've written an article about what VIES is.

In B2C you charge VAT to all customers. But the rate of VAT you charge depends on how much you’re selling within the EU. If your business stays below €10,000 in cross-border sales of digital goods per year, throughout the EU, then you can charge the VAT rate of your home country on all those cross-border sales. Once you pass the €10,000 annual sales threshold, you must charge the VAT rate of your customer’s country.

For non-European businesses, simple rules apply. In B2B you should reverse-charge VAT. In B2C transactions, always charge the VAT of the customer’s country.

EU VAT: How to comply in 5 easy steps

As complicated as it sounds, the whole process can actually be understood in five clear steps, from beginning to end.

- Register your business for a VAT number

- Verify who your customer is and where they are

- Charge VAT on transactions, when you need to

- Keep detailed invoices and records

- Submit VAT returns every quarter

Without further ado, let’s dive deeper into each one.

1. Getting Started: Register your company for EU VAT

First things first! Your business has to be registered in the VAT system to legally sell any digital goods within the EU. Depending on the country where you register, this could be a one-step or two-step process.

If your business is in the EU, simply register for VAT in your home country!

If you run a business outside of the EU, you can choose any EU country to host your tax registration. You must sign up with that country’s One-Stop Shop (OSS), a handy scheme that we will explain in full later on.

Don’t know which country to pick? Well, you have 28 to choose from. Here are some tips for choosing the right EU base for your VAT processes.

- A common language. Do you speak any of the languages within the EU? If so, go ahead and register in that country, so you can easily understand all tax documentation, guidelines, and processes.

- If you’re looking for an English-speaking base, Ireland is your best bet. But some other EU countries also offer their tax process in English, like Spain for example.

- A well-functioning website. By law, every EU member state must offer an online portal for EU VAT OSS. But to be honest, some countries are more on top of it than others. Later on in this guide, you’ll find the links to each national OSS page, and you can decide for yourself!

It’s important to know the difference between a local tax number and a VAT number. A local tax number only permits transactions locally, within that one country. A VAT number allows sales across borders, to other EU countries.

Some countries will automatically issue your business a VAT number when you register; others will only give you a local tax number at first, and require you go through an extra step for VAT.

For further insight, check out our article on how to register for EU VAT as a foreign business.

2. Acquiring a Customer: Verify your customer and their location

Attention, please! This step is super important to staying EU VAT compliant, both during and after the sale. It dictates everything about charging digital taxes (whether or not you add it, how much you add). Plus it provides you with necessary information for your tax records.

When you acquire a new customer in the EU, you need to answer two questions.

Is the customer a business or an individual person?

You must determine whether the customer is a fellow business or an end consumer. This is very important, because it determines whether or not you charge VAT at all.

- You should always ask the customer for their VAT registration number (VRN). Every business must have a VAT number. If the customer doesn’t have one, you can assume it’s a B2C sale.

- If the customer is a business (B2B), collect their VRN and confirm that the business is valid. Why? Because, sorry to say, some customers might pretend they are a business just to avoid paying the tax! So the best practice is to double-check their number with this validation tool from the European Commission.

Where is the customer located?

Confirm the customer’s location. This determines how much tax you charge. If you charge them too little, you’ll be on the hook later for that missing money! Tax season can be stressful already; you don’t want any surprise costs.

You must collect two pieces of evidence that confirm the location. This evidence could be:

- The billing address

- Location of the customer’s bank

- Country which issued the credit card

- The IP address location of the buyer’s device

- Country of the SIM card (in cases where the purchase was made on a mobile device)

- If you’re a European business that sells below €100,000 in cross-border sales of digital goods per year, throughout the EU, then you only need to collect one piece of customer location evidence. But it must be a piece of evidence gathered from a third party, such as the bank or IP address, and not from the customer directly.

Keep this location evidence on file for 10 years. Ten years?! Yep. ¯_(ツ)_/¯ We don’t make the rules, we just tell you about them.

But seriously, these records are necessary to prove you are tax compliant. So the best practice is to keep digital files, either in cloud-based storage or directly in your accounting/tax software, if you use one.

3. Point of Sale: Charge VAT if you need to

Here’s a quick recap of the section above titled, “When should you charge VAT?”

If you’re B2C, add VAT to every EU sale. If you’re a European business that sells less than €10,000 per year in the EU, add your home country’s VAT rate. If you sell more than that, add the VAT rate of the customer’s country. If you’re a non-European business selling B2C, you should always add the rate of your customer’s country. Those rates are listed in the next section!

If you’re B2B, add VAT to sales in your home country. But if the buyer is elsewhere in the EU and has a valid VAT number, you don’t need to add tax. The reverse-charge mechanism was created to simplify things for you. It’s the buyer’s responsibility to handle VAT on the transaction.

4. After the Sale: Provide (and keep!) detailed tax invoices

It wouldn’t be taxes if it didn’t require more tedious record-keeping… So, here we have the VAT invoice! It’s a crucial part of staying VAT compliant, and also will help you stay organized when the time comes to file your tax returns.

Every sale you make in the EU must have a VAT invoice to accompany it. Even those B2B sales where you don’t charge any tax – they need special VAT invoices, too.

What’s a VAT invoice? It’s a supercharged invoice that must include the following information:

- Your business’ name and address

- Your business’ VAT number (if you have one)

- Invoice date

- Invoice sequencing number

- Buyer’s name and address

- Buyer’s VAT number. If you’re using the reverse charge mechanism, include the text “EU VAT reverse charged”

- Rate of VAT applied

- Amount of VAT added

- Final amount after VAT is added

Wow, that’s a lot of stuff to include on what’s essentially just a sales receipt. Here’s an example of how to structure all the information so that it’s not only legible, but also pretty good-looking:

Keep each invoice on record for five years. Like keeping the location evidence, this is part of staying tax compliant. These records must be electronically available at the request of any official EU institution. So the easiest and most efficient way to store invoices would be as digital files, such as PDFs, just in case anyone comes knocking.

5. Reporting Taxes: Submit VAT returns every quarter

This last step is actually pretty straightforward, thanks to the One-Stop Shop.

You can file returns online, with the OSS where you’re registered. The website will tell you what information to enter for each country where you made a sale, and the OSS system will calculate how much VAT you have to pay.

From there you simply pay the entire bill to your OSS, which will then pass along the VAT to the various other EU countries on your behalf. It’s a one-and-done process, even if you’ve sold to customers in 20 different countries. Cool, right?

To get an even better sense of the process, you can read our quick guide on how to file VAT returns for an Irish OSS.

On the other hand, if you’re a European business that sells less than €10,000 per year in the EU, then you can simply file your VAT returns with your home country. You don’t need to use the OSS scheme.

As for when to file your EU VAT returns, you do it at the end of each quarter. From the end of the quarter, you have 20 days to file and pay whatever you owe. So the VAT return deadlines are as follows:

- 20 April, for the first quarter ending 31 March

- 20 July, for the second quarter ending 30 June

- 20 October, for the third quarter ending 30 September

- 20 January, for the fourth quarter ending 31 December

If you want more detailed advice on filing VAT (and to make sure you do it right!), take a look at our list of nine common VAT-filing mistakes and how to avoid them.

How exactly does the “reverse charge” mechanism work?

As a seller, you may be curious why you don’t need to charge VAT to any EU businesses. Maybe the reverse-charge mechanism sounds too good to be true. Well, here’s a quick explanation of how it works!

The reverse-charge method is designed so that the buyer must report VAT on their own business purchases, effectively cutting you out as the tax middleman. It’s actually quite logical. In a typical process, a B2B customer would pay you tax on your business product, and you would pay the tax forward to the appropriate tax authority. Later the customer would reclaim that same amount as a tax break and get reimbursed. The money would go in a circle from buyer, to you, to the tax authority, then back with the buyer.

So why not make it one smooth step? Why not let the customer just keep the money in their bank account, and file the appropriate tax paperwork all at once?

Thus the reverse-charge mechanism was born! This is great for you, because it means you don’t need to register for taxes in every EU country where you have a business buyer.

For a more in-depth explanation, read on about how the reverse-charge mechanism works around the world.

How exactly does the One-Stop Shop (OSS) work?

Disclaimer: If you run an EU business that stays below €10,000 in cross-border EU sales of digital goods per year, then you do not need to use VAT OSS. Your tax scheme is simple. You register in your home country, you charge your local tax rate to all customers, and you file returns with your home country. Voilà.

The One-Stop Shop (OSS) debuted in 2015 to simplify returns for digital taxes, so that you don’t have to register for VAT in every EU country where you have a customer.

In your home country (or if you are a non-EU business, in the EU country of your choice), you register for a OSS with the local tax authority. Each country has their own process for registration, so check with them for more specific instructions.

From there, this is how the taxes work each year:

- You submit one single VAT return to your OSS. You do this online.

- The OSS calculates how much money you owe in taxes.

- Then your OSS distributes VAT appropriately among the other EU states and their local OSS.

It’s a surprisingly simple process for the usually complex world of digital taxes!

Don’t want to go the OSS route?

That’s okay, it’s not mandatory. But the alternative might be quite a hassle!

You must register for EU VAT in each country where you have a customer. Then you must keep records according to local policies and file separate tax returns based on each country’s individual deadlines.

Clearly, if you sell over €10,000 per year to a multi-national customer base, then forgoing OSS could add a lot of work on your plate. Here are some pros and cons between using OSS and doing local VAT registration instead:

| One-Stop Shop (OSS) | Local VAT Registration |

|---|---|

| Less administration | More complexity |

| One quaterly filing applies to the entire EU | Filing separate returns in each country where there's a transaction; up to 28 quaterly filings |

| Shorter filing and payment deadline, within 20 days of the end of each quarter | Filing and payment deadlines depend on each EU state |

| Long record-keeping requirement | Record-keeping rules depend on each EU state |

| Slow input tax recovery | Fast repayments of incurred VAT |

FAQ about VAT

I sell digital goods. Can I be exempt?

To date, there are no exemptions from these digital taxes. Everybody has to pay up! The only exemption to EU VAT digital taxes is for European businesses that stay below €10,000 in cross-border EU of digital goods per year. These businesses are exempt from using the VAT OSS registration and filing scheme, but still must collect taxes on their sales.

I sell physical goods. Do I have to pay EU VAT?

Nope. These guidelines do not apply to physical products, but there are other VAT rules for your business. Check out our guide to distance selling in the EU and how to do it right. Or read more about how to handle sales tax for physical products around the world.

Can I still operate my business even if I don’t comply with EU VAT rules?

Any business that provides e-services or sells digital goods to EU customers must register for VAT and comply. If you don’t register for VAT and continue operating your business, you may have to pay years of back-taxes plus a fine for non-compliance.

My business is not based in the EU. Do I have to pay this VAT?

Yes, you must pay it on any B2C transactions, or transactions where your buyer does not have a valid VAT number.

I’m selling my products or services through a marketplace. Do I have to comply with these VAT rules?

Some marketplaces will take care of VAT for you:

- Amazon Kindle Direct Publishing

- Bandcamp

- Envato

But not all marketplaces take on this responsibility. Double check what the policy is with your marketplace. Otherwise you might unknowingly fail to comply with VAT and end up in a sticky situation.

Selling through Amazon FBA? Find out how Amazon FBA affects your EU VAT obligations.

Further Resources

We have studied, synthesized and distilled all of the current EU VAT regulations, and put them here in this guide so they are easy to read and simple to understand. If you’d like to read more from the ultimate authority, here are some helpful sites from the official EU Taxation and Customs Union:

Note: At Quaderno we love providing helpful information and best practices about taxes, but we are not certified tax advisors. For further help, or if you are ever in doubt, please consult a professional tax advisor or the official Department of Revenue.