If you’re selling digital services and products to customers in Pennsylvania, then you might be liable for the state’s sales tax. This guide helps you with:

- How to use myPATH to register for sales tax in Pennsylvania

- How to apply for a Sales Tax License in Pennsylvania

- How to file a sales tax return in PA

- How to pay sales tax in PA

- What the PA sales tax rate is

We’ve scoured the Pennsylvania Department of Revenue website to provide you with all the necessary information about sales tax for businesses in one place.

How to Register for Sales Tax in Pennsylvania with myPATH

Remote sellers can register online for sales tax in Pennsylvania (PA) through an account with Pennsylvania Tax Hub (PATH), an online tax portal that’s also called myPATH. This portal offers a "Pennsylvania Online Business Tax Registration" service. It’s also where you’ll file and pay your tax returns. More on that later!

Note: The Pennsylvania Online Business Entity Registration (PA-100) has been replaced with myPATH's "Pennsylvania Online Business Tax Registration" service.

Signing up for MyPath to Pay PA Sales Tax

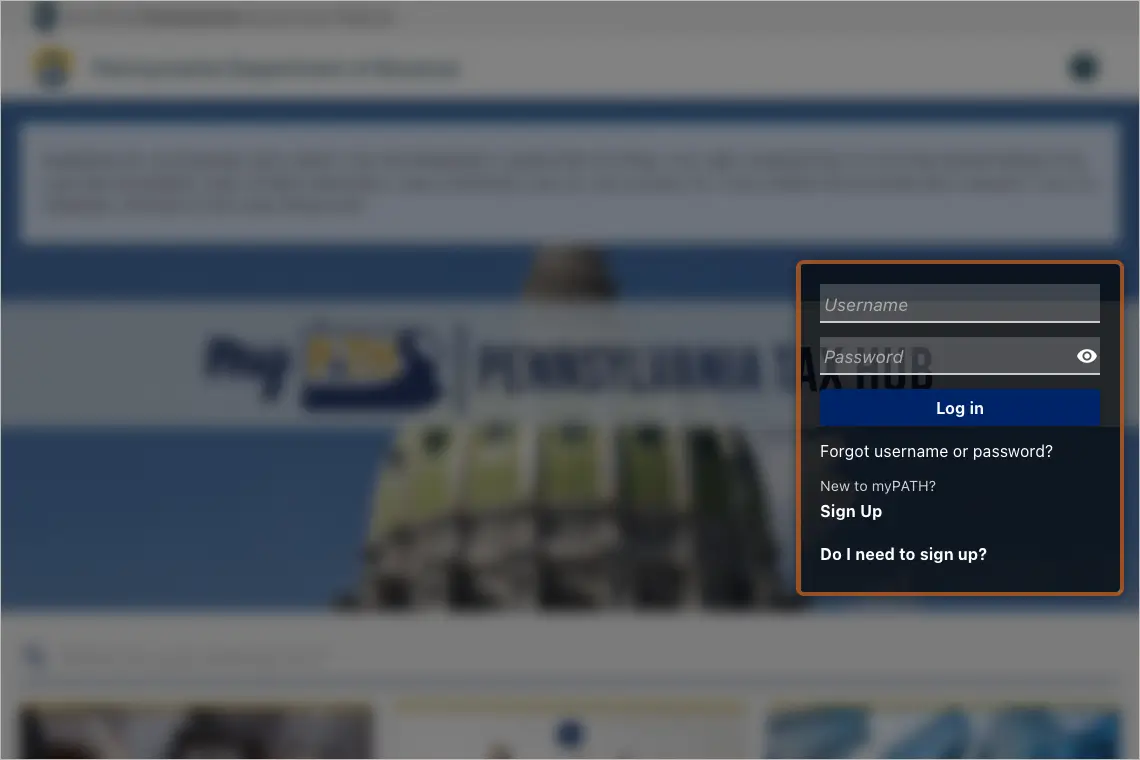

1. Go to the Pennsylvania myPATH website. Under the log-in section, click “Sign Up.”

- On the next window, simply click “Next.”

- On this window, review the Electronic Correspondence and Communications Agreement and finally check the box to confirm you agree to the terms. Then click “Next.”

- Now create login information for your account. Choose an email address, a password, and enter your phone number.

In the Identification field, select “No,” then provide Federal Employer ID, also known as the EIN. Learn more about the EIN here.

- Check the email you provided to sign up. In your email, you’ll find a confirmation code that you must use to log into your new account for the first time. As an extra security measure, myPATH will also ask you to set up two-factor authentication.

- Once your account is created, you will be assigned an 11-digit Account ID.

Note: Once you receive your sales tax license, you’ll receive another 8-digit number that is your License ID. Both of these are important.

How to apply for a Sales Tax License in Pennsylvania

The next step is to apply for a sales tax license. Before you begin, have this information handy:

- Your Employer Identification Number (EIN) if you have one.

- The date of your first sale in Pennsylvania

- The names of Pennsylvania counties where your customers live

Then go to your myPATH account dashboard and follow these steps:

- In your myPATH account dashboard, click on the “Pennsylvania Online Business Tax Registration” service.

- Select to apply for a “Pennsylvania Sales, Use and Hotel Occupancy Tax License.”

- Follow the steps and fill out the required information about your business, products and customers.

- At the very end, you’ll have a chance to review all the information you’ve provided and make sure it’s correct. Then, finally, you can submit! You’re done!

- You will receive your sales tax license number by email in about 3 business days. This is an 8-digit License ID that you should keep on file. The actual license will be mailed in 7 to 10 business days.

Note: You are required to renew your sales tax permit every 5 years, and you do that online.

Once you’re registered for sales tax in PA, you’ll also be assigned a tax filing frequency: monthly, quarterly, or semiannually.

How do I file sales tax returns in Pennsylvania?

Sales and taxes should be reported and filed using US dollars. If you’ve made any transactions in Pennsylvania in a different currency, be sure to convert those to USD using official currency exchange rates.

When to file and pay

You must file a sales tax return either monthly, quarterly, or semiannually. The deadlines are as follows:

Monthly

For monthly filers, reports are due on the 20th day of the month following the reporting month. For example, the July sales tax report is due August 20.

Quarterly

For quarterly filers, reports are due on the 20th day of the month following the reporting period.

- April 20, for first quarter ending March 31

- July 20, for second quarter ending June 30

- October 20, for third quarter ending September 30

- January 20, for fourth quarter ending December 31

Semiannually

Semiannual filers get an extra month before their deadline, but the due date is always the 20th of the month.

- August 20, for the first half of the year

- February 20, for the second half of the year

Note: Didn’t make any sales in Pennsylvania during your reporting period? You should still report that. This is often called a “zero return” and it follows the exact same process as a normal return. (Just a little less data entry 😉)

How to file returns in Pennsylvania

Before you get started, you should collect all the information about your taxable sales in Pennsylvania during the previous quarter. The tax website suggests having these pieces ready:

- total sales and income

- total purchases and expenses

You can file the return online using myPATH. Log in with that same UserID and password here. To verify your identity, you can provide either your 11-digit Account ID or your 8-digit License ID.

How to pay sales tax in Pennsylvania

Tax payments must be made electronically and in US dollars. You can pay directly at the time of filing in myPATH.

Payment options include:

- Bank transfer, by providing your bank account and routing information.

- Credit or debit card. A convenience fee will be charged.

What the PA sales tax rate is

The sales tax rate in Pennsylvania is 6%. But there are also local level taxes you should look out for, depending on the counties and cities where you’re selling.

Now that you’re registered, you must comply with all the rules for Pennsylvania sales tax! To learn more about these rules and how to stay compliant as a remote seller, check out our Guide to Sales Tax in Pennsylvania.

Note: At Quaderno we love providing helpful information and best practices about taxes, but we are not certified tax advisors. For further help, or if you are ever in doubt, please consult a professional tax advisor or the tax authorities.