Sales tax compliance for online businesses doesn’t need to be a burden.

Yes — VAT, GST, and sales tax laws are confusing and always changing.

But in an age where almost everything is automated, shouldn’t consumption taxes be automated, too?

You have enough on your plate as it is!

Business owners, whether you’re a SaaS founder, e-commerce entrepreneur or digital consultant, don’t have to manage this manually.

In fact, almost every step of the sales tax process can be automated and built into your business operations. So you have more time to focus on the stuff you love – be that creating amazing products, building customer relationships, or just spending time with your family.

With decades of experience, we're sharing our true and tested tips in this guide so you can begin to automate sales tax for your business, too. Get ready to take some notes!

Track & Register

It’s imperative that fast-growing businesses, and those that aspire to grow fast, know exactly how much they’re selling, in every place they’re selling.

Why?

Because there are two tax missteps you can make as you grow:

- Not registering for sales tax when you’re required to, and then later paying out of pocket all the sales tax that you should have been charging your customers.

- Collecting taxes when you ha registered for it, and then facing fines or other legal consequences.

That’s why we’ve named the first step of the tax process “Track & Register,” because you need to track your sales and register in the right places on time.

The best sales tax compliance software will do 3 things for your business:

- Track where your business is currently registered for sales tax, VAT or GST.

- Monitor where your business might be liable for sales tax next.

- Alert you proactively when it’s time to register for your business in a brand new place.

1. Track your business’ tax registrations

Why is this important?

As your business expands, you enter more tax jurisdictions that might have their own registration policies, rates, and rules. And these obligations can be very different.

For example: If you make your first sale in Germany, you better register for EU VAT right away. But if you make your first sale in New York, you probably don’t need to register for sales tax until you sell $500,000 in that state alone.

A tax jurisdiction is basically a geographic area that has its own rules. It could be a country, region, group of countries, province, state, city, county, district or other local authorities.

As you can see, there are many levels, and sometimes your business needs to answer to multiple levels of government at once.

What Quaderno can do:

All of your business tax registrations are visible in one place, set up and recorded digitally. You can easily update, edit, add or remove these registrations at any time.

Quaderno also stores your registration numbers and tax IDs digitally, then automatically stamps them on any receipts, invoices, reports, or other necessary documents. More on that later!

2. Monitor your sales in every jurisdiction

Why is this important?

As you grow, you’ll probably become liable for taxes in new places, and you need to stay on top of this to avoid those two missteps mentioned above. (Fines, fees, and lawyers, oh my!)

Each tax jurisdiction might have its own tax registration threshold, including separate ones for physical or digital products.

When your sales pass the tax threshold, you must register and start collecting taxes. Or the country/state/city might not have any threshold at all, which means you are liable for taxes from the very first sale.

Manually monitoring your sales in every place where there’s a tax threshold would be a seconull-time job. Nobody has time for that, especially not you

What Quaderno can do

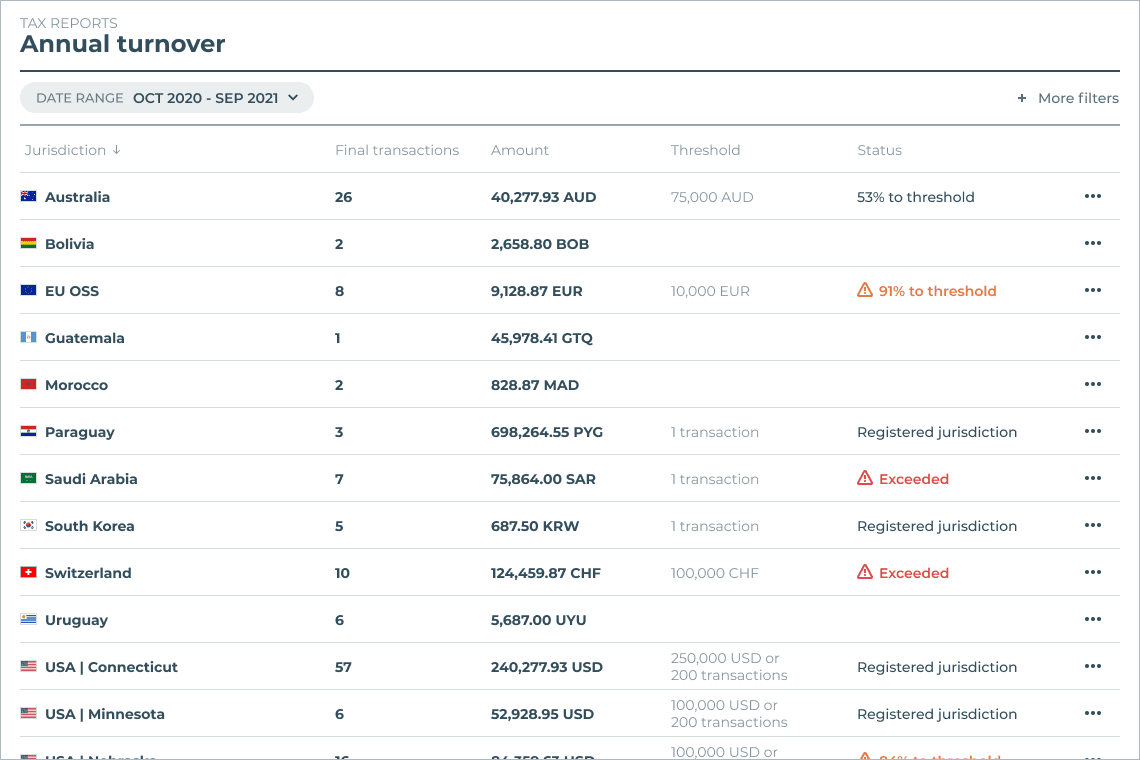

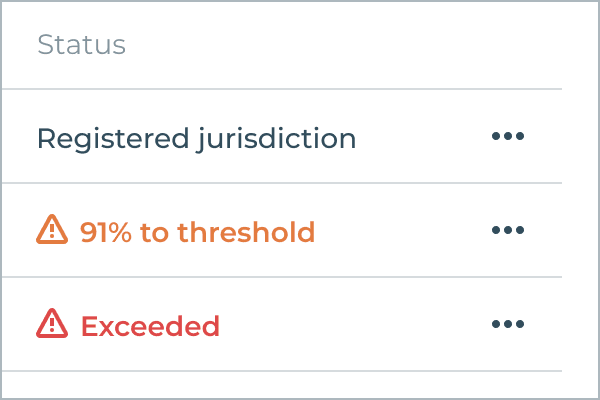

The app offers automatic sales tracking in real time, no matter where you’re selling, and measures those totals against each jurisdiction’s threshold rules. Plus Quaderno visualizes the data for you. Check it out:

3. Alert you proactively when it’s time to register

Why is this important?

When you’re growing quickly, you might be making sales in a brand new country every month, week, or day. While this is super exciting, it’s a lot to keep track of, logistically and legally, on top of everything else.

Even the most hands-on business owners might not catch each new tax jurisdiction as it happens — or catch each registration threshold as it’s hit.

Tax automation software should keep an eye on this for you and alert you when necessary. That way you can focus on the parts of your business that you love, not this tedious stuff.

What Quaderno can do

Thanks to Quaderno’s turnover reports and real-time data tracking, the system will alert you when:

- Your sales have hit 100% of the threshold (letting you know it might be go-time for tax compliance!)

- Your business is liable for a new tax because you’ve made a sale in a new place, where there’s no registration threshold.

You’ll receive these notifications both in the app and via email. Who doesn’t love a heads up about important info? Especially when it can save you time, money, and stress.

Verify & Calculate

Online businesses must know three things at the point of sale,the payment goes through:

- Who they’re selling to

- Where they’re selling to

- What they’re selling to that customer

Your tax compliance hinges on this step!

Each piece of information helps determine the correct amount of sales tax, VAT, or GST that you’re required to charge and collect from the customer.

Each piece of information requires some forethought or follow-up, unless you have a tax-compliant customer verification process built into your checkout flow.

The best tax compliance software will do 5 things for your business:

- Confirm whether the sale is B2C or B2B

- Verify VAT numbers and other business tax IDs

- Collect and store customer location evidence

- Detect which type of products are being purchased

- Calculate the correct amount of tax at the point of sale

1. Confirm whether the sale is B2C or B2B

Why is this important?

You need to make sure the sale actually requires tax! Generally, B2B sales do not need consumption tax to be added to the transaction. That’s because business purchases can either be tax-exempt or the reverse-charge mechanism applies.

B2C sales, on the other hand, are taxed on the spot.

What Quaderno can do

Quaderno requests business tax registration numbers, or tax IDs, in the checkout process. If a business tax ID is provided, the system will automatically classify the transaction as B2B. Not only will this give you automatic insight into your own customer base, it ensures you won’t make any missteps in the rest of the tax process.

2. Verify all VAT numbers and other business tax IDs

Why is this important?

Unfortunately, there’s a problem of VAT fraud, wherein people provide false business IDs so they can avoid being charged consumption tax. In places that are cracking down on fraud, such as the EU, it’s your responsibility to verify that these business tax IDs are valid!

What Quaderno can do

Quaderno’s technology will automatically verify EU VAT numbers through the European Commission’s official validation system, VIES. If the tax ID is invalid, then the sale will not go through. This protects you from any consumption tax fraud, and ensures you won’t have to pay extra tax out of pocket.

3. Collect and store customer location evidence

Why is this important?

The customer’s location determines the tax you must apply in most scenarios. “Location evidence” is two non-conflicting pieces of data that prove where the buyer is based.

Many countries require you to collect customer location evidence and keep it in your records for years. The EU requires you to store it digitally for 10 years!

The evidence could be:

- The billing address

- Location of the customer’s bank

- Country which issued the credit card

- The IP address location of the buyer’s device

- Country of the SIM card (in cases where the purchase was made on a mobile device)

What Quaderno can do

Quaderno will extract location evidence from the transaction data and check if two pieces match. If they do match, the evidence will be stored securely for as long as you need. If they don’t match, you’ll see an alert in the app that you must follow up with the customer and complete your records.

4. Detect which type of products are being purchased

Why is this important?

The type of product determines what tax you must charge. Goods and services can be taxed differently. For example an online course could be taxed at 17% while an eBook is zero-rated or has a tax rate of 0%.

Your business must categorize its products in the right tax classes, so that what you collect from customers aligns with what the government will expect from you later!

What Quaderno can do

Quaderno will save all of your different products, with the settings configured to the correct tax class in each jurisdiction. So when you make a sale, that product code will trigger the accurate tax calculation. And you never have to second guess or do it yourself!

5. Calculate the correct tax on the transaction & collect at the point of sale

Why is this important?

Well, this is pretty obvious. But given that you’re legally bound to charge and collect tax from the buyer, it’s better if you get the amount correct on the first try. You don’t want to chase up any customers after the sale! That makes for a poor customer experience, plus it’s a huge hassle for you.

A reliable, automated system will make sure the correct amount of tax is calculated and collected every time.

What Quaderno can do

The app performs automatic tax calculation on every sale you make, no matter which channels and payment processors you’re using. In fact, Quaderno offers integrations with all of the most popular platforms. If you sell on your own website, Quaderno will add automatic tax calculation to your checkout process seamlessly.

Quaderno stays up-to-date with tax rates and policies as they change around the world, so the rate is always accurate.

Invoicing

The invoicing element of the tax process is pretty straightforward.

You must send tax-compliant invoices after every sale or refund. These documents are for both your customers and your own business records.

Plus, tax receipts are necessary if you or your customers want to claim any deductions for the purchase.

The best tax compliance software will do 3 things for your business:

- Send tax-compliant documents automatically

- Customize invoices or receipts to every jurisdiction

- Provide a billing dashboard for users

1. Send tax-compliant documents automatically

What makes an invoice tax-compliant?

Generally, the following information should be on the document:

- Your business’ name and address

- Your business’ tax ID (if you have one)

- Invoice date

- Invoice sequencing number

- Buyer’s name and address

- Buyer’s tax ID number (if you’re using the reverse-charge mechanism, you may need to include the text “reverse charged”)

- Rate of tax applied

- Amount of tax added

- Final amount after tax is added

If you’re doing anything B2B, you definitely need your tax ID to use the reverse-charge mechanism. Your business tax ID should also be on every receipt, invoice, credit note, or return.

What Quaderno can do

Quaderno provides automatic tax invoicing for every transaction. The app will send tax-compliant receipts, invoices, and credit notes automatically, on the spot. You can also set up recurring billing.

All of your business's tax IDs will be clearly logged, assigned to the right tax jurisdictions, and automatically entered on important business documents.

2. Customize invoices or receipts to every jurisdiction

Why is this important?

Invoices and receipts are an often overlooked part of the customer journey. These documents are actually another touchpoint with your customer and a chance for you to make the best impression!

Receipts are easier to read and understand if all of the information is presented clearly. This is especially the case when you’re selling abroad to customers who speak another language or use a different currency.

Sending customized, automatic receipts keeps tax records clear for everyone.

What Quaderno can do

Quaderno allows you to customize invoices and receipts to match your brand. Not only that, the app creates documents in your customer’s local language and currency. Now that’s customer service!

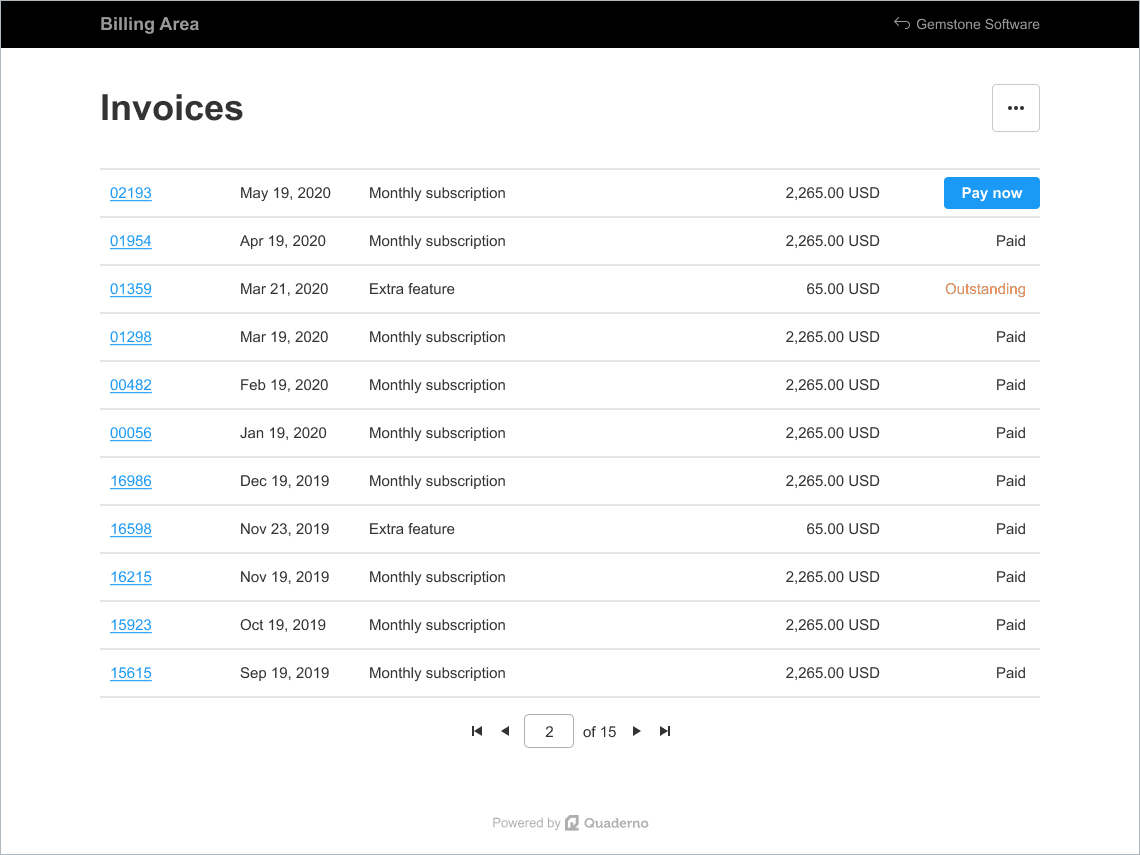

3. Provide a billing dashboard for users

Why is this important?

A billing dashboard gives your customers clarity around all the purchases they’ve made with your business. More importantly, the dashboard gives them access to their own documents and tax records.

So if your customer has misplaced a tax receipt and needs a new one for their records — or if they simply want to review purchases or update their billing information — they can do this all on their own. No emails or calls to you or your support team.

What Quaderno can do

Quaderno offers a billing dashboard for each of your customers. This self-service customer support option saves you time, money, and stress. Plus, it creates a much better user experience.

Report & File

One of the biggest headaches of sales tax compliance is filing returns. Getting your business numbers right and filing on time is crucial for your business.

Unfortunately, tax returns themselves cannot be automated right now. Every jurisdiction has its own particular online filing system. You must log on to enter the necessary information and make payments.

BUT

The best tax compliance software would produce detailed tax reports so you can file a return in mere minutes.

The reports provide ongoing financial clarity. You know how much tax money you owe in real time, and this continuously updates as your online store makes sales around the country and the world.

More importantly, such reports provide instant data when you need to file a return by the deadline.

What Quaderno can do

With Quaderno’s instant tax reports, you can understand your tax liability in any jurisdiction at a glance and file a return in mere minutes. The app tracks how much tax you’ve actually collected in each jurisdiction, and displays all the necessary information in one place. This makes filing tax returns a matter of data entry.

Or, if you'd rather leave tax returns to the professionals, we'll connect you with a verified tax filing service!

What’s next?

Life’s too short, and your business too important, to waste valuable time and resources managing taxes!

Let Quaderno help you out.

**Start a risk-free trial today** No credit card, no obligation. Just a quick setup to integrate your other business platforms, and we’ll start automating VAT, GST, & sales tax for you.

Note: At Quaderno we love providing helpful information and best practices about taxes, but we are not certified tax advisors. For further help, or if you are ever in doubt, please consult a professional tax advisor or the official Department of Revenue.